Introduction

- Maximizing Your Savings with Insulation Rebates

- Why Insulation Matters for Energy Efficiency and Cost Savings

- What Are Insulation Rebates and Government Incentives?

- Types of Insulation Rebates and Incentives

- How to Find Insulation Rebates and Incentives

- Qualifying for Insulation Rebates and Incentives

- Steps to Claiming Insulation Rebates

- Examples of Popular Insulation Rebate Programs

- Conclusion

Taking advantage of insulation rebates and government insulation incentives is a smart way to make your home more energy-efficient while reducing the upfront cost of insulation upgrades. These programs are designed to help homeowners save money with insulation by offering rebates, tax credits, and financial incentives for improving energy efficiency. In this guide, we’ll explore the various types of rebates and incentives available, how to qualify for them, and how they can significantly reduce the cost of upgrading your home’s insulation.

Maximizing Your Savings with Insulation Rebates

Insulation rebates offer homeowners an excellent opportunity to reduce the cost of improving their home’s energy efficiency. Many federal, state, and local programs provide rebates specifically for insulation upgrades, allowing you to save on both materials and installation. These rebates often cover a significant portion of the costs, making energy-efficient insulation more accessible. To take full advantage of these offers, it’s important to research available programs in your area, ensure that your insulation project meets the eligibility requirements, and submit your rebate applications on time to maximize your savings.

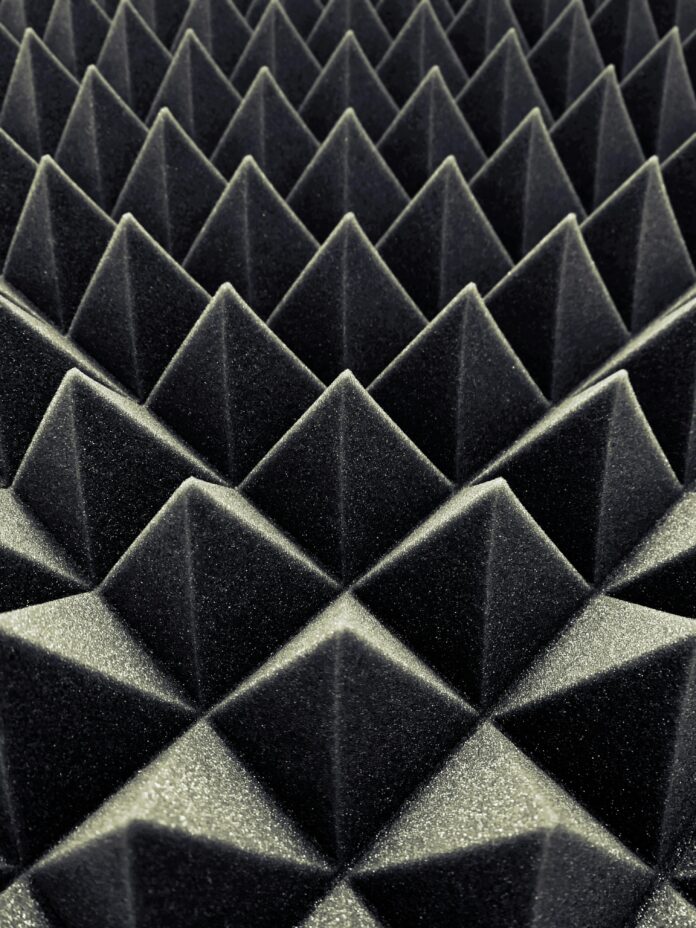

Why Insulation Matters for Energy Efficiency and Cost Savings

Insulation is essential for keeping your home both comfortable and energy-efficient by regulating indoor temperatures and reducing energy loss. By reducing heat transfer through walls, attics, and floors, proper insulation helps keep homes warmer in the winter and cooler in the summer, reducing the need for heating and cooling systems to work overtime. This allows homeowners to substantially reduce their energy costs over time.

Over time, the savings from reduced energy usage can pay for the cost of the insulation itself. However, upfront costs for quality insulation materials and installation can be a concern. That’s where rebates and government incentives come into play, making energy-efficient upgrades more affordable and accessible.

What Are Insulation Rebates and Government Incentives?

Insulation rebates and government incentives are financial programs designed to encourage homeowners to improve their energy efficiency by upgrading their insulation. These programs offer rebates, tax credits, or discounts to reduce the cost of purchasing and installing insulation materials. Governments and utility companies often provide these incentives to promote energy conservation, reduce carbon emissions, and lower the overall demand for energy.

In many cases, these incentives cover a significant portion of the cost, making insulation upgrades more affordable and attractive for homeowners.

Types of Insulation Rebates and Incentives

There are several types of insulation rebates and incentives available at different levels:

- Federal Tax Credits: Many countries, including the U.S., Canada, and the UK, offer federal tax credits for energy-efficient home improvements, including insulation upgrades.

- State and Local Rebates: In addition to federal programs, individual states, provinces, or municipalities may offer their own rebate programs to encourage local homeowners to improve energy efficiency.

- Utility Company Rebates: Many utility companies partner with energy-efficiency programs to provide rebates or discounts for customers who upgrade insulation. These rebates can be applied directly to the purchase of materials or installation services.

- Energy-Efficiency Programs: Programs like Energy Star and other government-backed initiatives often offer rebates or financial incentives for homes that meet energy-efficiency standards, including proper insulation.

How to Find Insulation Rebates and Incentives

Finding available rebates and incentives for insulation upgrades can be easier than you think:

- Search Government Websites: Most federal and state energy departments maintain websites listing available rebates and incentives for home improvements. The U.S. Department of Energy, for example, offers a comprehensive database of state and federal energy-efficiency programs.

- Work with Contractors: Many professional insulation contractors are familiar with local rebate programs and can help guide you through the process of finding and applying for available incentives.

- Use Rebate Finder Tools: Websites like Energy Star, DSIRE (Database of State Incentives for Renewables & Efficiency), and other similar platforms offer tools to search for rebates and incentives based on your location and the type of insulation project you’re undertaking.

Qualifying for Insulation Rebates and Incentives

Homeowners usually need to meet specific requirements to be eligible for insulation rebates and incentives:

- Energy-Efficiency Standards: The insulation being installed must meet or exceed energy-efficiency standards set by the program offering the rebate. This usually means choosing insulation materials with high R-values and air-sealing capabilities.

- Qualifying Insulation Materials: Not all types of insulation are eligible for rebates. Programs may specify certain materials like spray foam, fiberglass batts, or cellulose that qualify for rebates based on their energy efficiency.

- Proper Documentation: Homeowners may need to provide receipts, invoices, and product specifications to prove that the insulation meets the program’s requirements.

Steps to Claiming Insulation Rebates

Claiming insulation rebates typically involves a few simple steps:

- Save All Receipts: Be sure to keep detailed receipts and documentation of the insulation materials you purchase and any professional installation services you use.

- File for Federal Tax Credits: If you qualify for a federal tax credit, file the appropriate forms with your income tax return. For U.S. residents, this usually involves Form 5695.

- Submit Applications for Local Rebates: Check with your state, local government, or utility company to find out how to apply for rebates. Some may require an online submission, while others may need paper applications.

Examples of Popular Insulation Rebate Programs

- Federal Residential Energy Efficiency Tax Credit (US): This program allows homeowners to claim up to 10% of the cost of insulation materials (excluding installation) as a tax credit on their federal income tax return.

- Home Renovation Incentive (Canada): In certain provinces, homeowners can receive rebates for energy-efficiency upgrades, including insulation improvements.

- Green Homes Grant (UK): A UK government initiative that provides homeowners with grants to cover up to two-thirds of the cost of insulation and other energy-efficiency improvements.

Conclusion

Insulation rebates and government incentives provide a valuable opportunity to improve your home’s energy efficiency while saving money. By taking advantage of available programs, you can reduce the cost of upgrading your insulation, lower your energy bills, and make your home more environmentally friendly. Explore the rebate options in your area today, and start saving with energy-efficient insulation.